How To Calculate Depreciation If Salvage Value Is Not Given

Units of production depreciation does use salvage value so your first year calculation would look like this. Divide this amount by the number of years in the assets useful lifespan.

Straight Line Depreciation Double Entry Bookkeeping

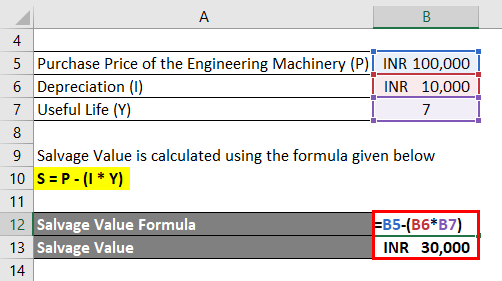

S Salvage value.

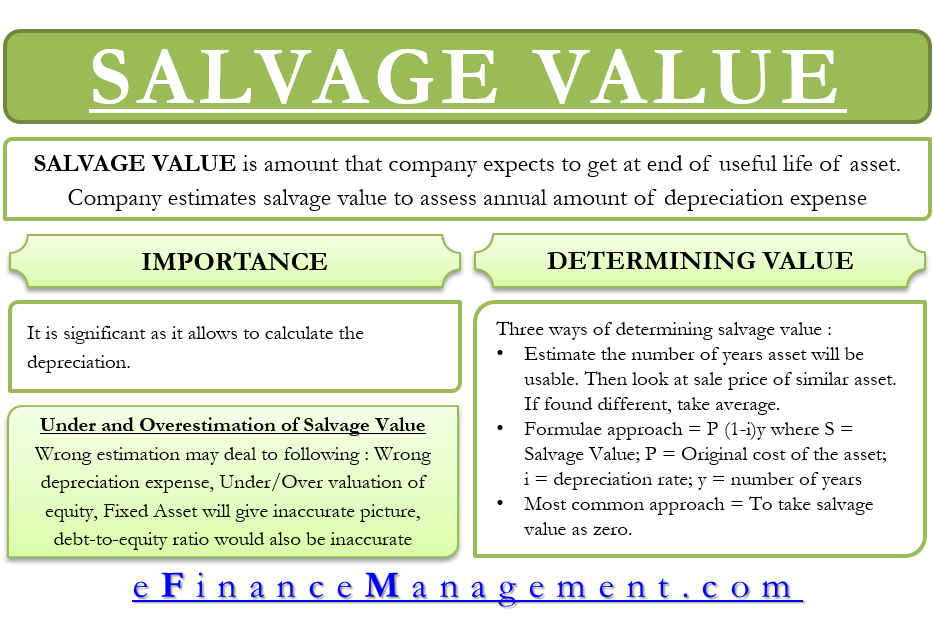

How to calculate depreciation if salvage value is not given. When calculating depreciation an assets salvage value is subtracted from its initial cost to determine total depreciation over the assets useful life. Salvage Value is a key component in accurately calculating the deprecation of fixed assets for financial reporting purposes but is generally not a factor for tax depreciation under MACRS. Three Main Methods of Calculating Depreciation To calculate depreciation subtract the assets salvage value from its cost to determine the amount that can be depreciated.

S o VD R 1 C o SV AD. The relevant information is given below. This means that for every copy produced youll multiple that number times 0015.

To calculate depreciation expense on a fixed asset without a salvage value the cost is divided by the life. Determine the useful life of the asset. As a result the entire cost of the asset used in the business will be charged to depreciation expense during the years of the assets expected useful life.

When a company purchases an asset first it calculates the salvage value of the asset. Divide by 12 to tell you the monthly depreciation for the asset. Calculating the Sum of the Years Digit when the Annual Depreciation the Remaining Years of the Asset Useful Life Beginning from the Last Year of its Life the Salvage Value or Scrap Value and the Original Cost is Given.

S o VD Sum of the Years Digit. Therefore the salvage value or scrap value is 375. The company XYZ purchased a machine on January 1 2019.

And then divided by. Calculating the Present Amount or Worth when the Book Value the Salvage Value the Total Estimated Life of the Asset and the Number of years of the Asset is Given. P Present amount or worth.

P B x N t S. Cost of the machine. These steps should be repeated annually throughout the assets useful life.

Prepare a schedule showing the depreciation expense of each year of the useful life of the machine using sum of years digits method. Accumulated depreciation is calculated by subtracting the estimated scrapsalvage value at the end of its useful life from the initial cost of an asset. Just put a 0 in any place where you need to enter a salvage value.

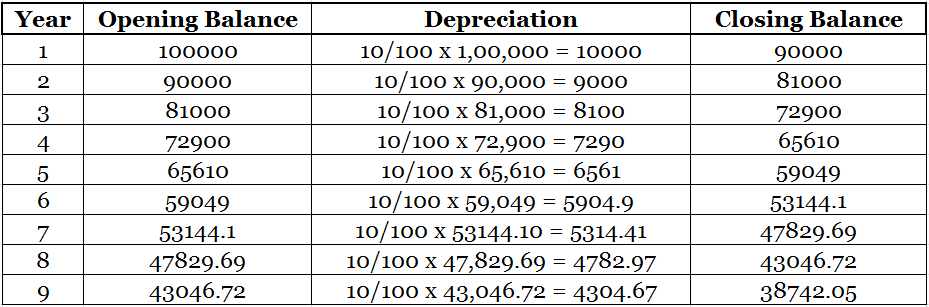

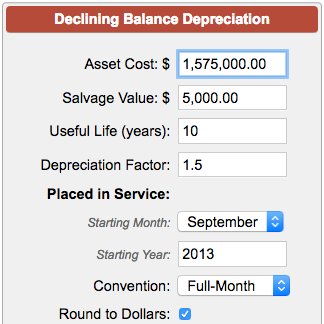

Depreciation charge per year net book value residual value x depreciation factor Step 2. Subtract the depreciation charge from the current book value to calculate the remaining book value. Depreciation is calculated by taking the useful life of the asset available in tables based on the type of asset though you may need an accountant for this less the salvage value of the asset at the end of its useful life also determined by a table divided by the cost of the asset including all costs for acquiring the asset like transportation set-up and training.

Divide the sum of step 2 by the number arrived at in step 3 to get the annual depreciation. B Book value over a period of time. Thereafter this value is deducted from the total cost of the assets and then the depreciation is charged on the remaining amount.

In essence Salvage Value is the anticipated value of a depreciable asset when it reaches the end of its Useful Life. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Perhaps the most common calculation of an assets salvage value is to assume there will be no salvage value.

From there accountants have several. SL Cost Life Example. You can still calculate depreciation without a salvage value.

N Total estimated life of an asset. Annual depreciation purchase price - salvage value useful life According to straight-line depreciation this is how much depreciation you have to subtract from the value of an asset each year to know its book value. Expected useful life of machine.

A table is purchased for 56765. The expected life is.

How To Use The Excel Amorlinc Function Exceljet

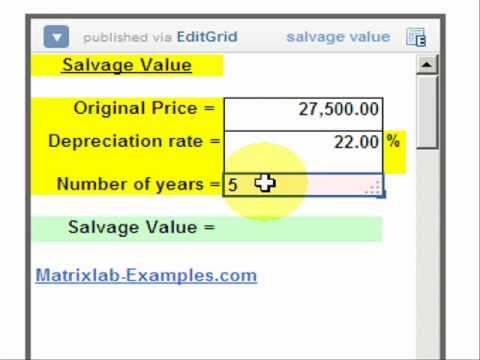

Salvage Value Calculation Youtube

Salvage Value Formula Calculator Excel Template

Straight Line Depreciation Formula Guide To Calculate Depreciation

How To Calculate Book Value 13 Steps With Pictures Wikihow

Depreciation Of Operating Assets

Salvage Value Formula Calculator Excel Template

Straight Line Depreciation Accountingcoach

4 Ways To Calculate Depreciation On Fixed Assets Wikihow

Straight Line Depreciation Formula Guide To Calculate Depreciation

How To Calculate Scrap Value Of An Asset Accountingcapital

Declining Balance Depreciation Calculator

Salvage Value Formula Calculator Excel Template

Salvage Value Meaning Importance How To Calculate

How To Use The Excel Db Function Exceljet

Depreciation Expense Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Salvage Value Formula Calculator Excel Template