How To Calculate Depreciation Expense On Real Estate

It works out to being able to. If you can sell the property for 280000 you will recognize a gain of 184540 280000 minus 95460.

How To Calculate Land Value For Taxes And Depreciation Retipster Land Value Tax Corporate Action Dividend Reinvestment Plan

Acquisition Cost x Depreciation rate The necessary information needed for the above calculation are building acquisition cost building and land ratio useful life of a building and depreciation rate.

How to calculate depreciation expense on real estate. While its always recommended that you work with a qualified tax accountant when calculating depreciation here are the basic steps. Then we divide 8075 by the current property value of 90000 and the result is 897. The IRS also allows 150 declining balance for five and 7-year property if that is an investors preference.

The basis of the property is its cost or the amount you paid in cash with a. Then we divide 11900 by the current property value of 140000 and the result is 850. 1 You consider the asset as one asset.

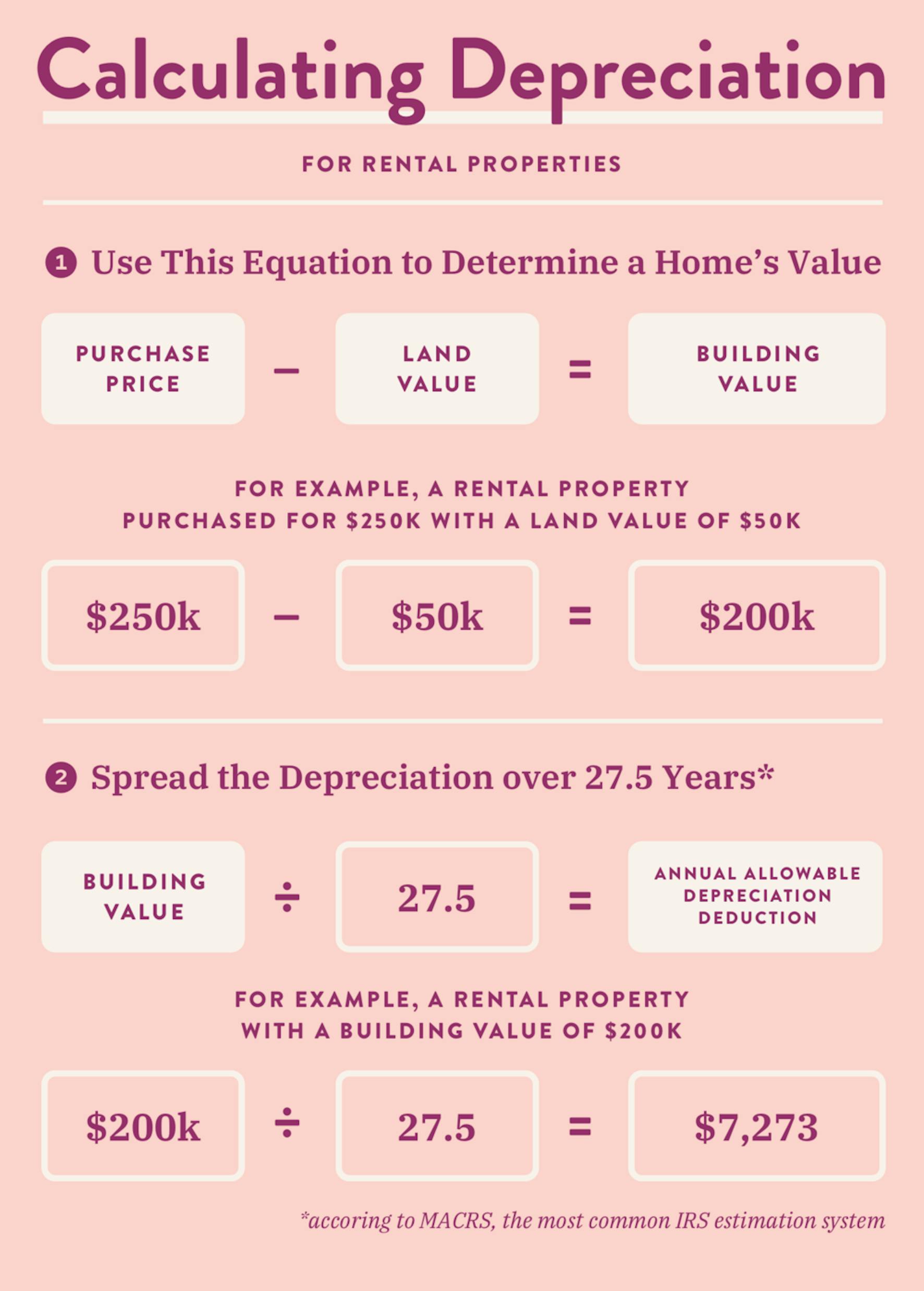

In our example lets use our existing cost basis of 206000 and divide by the GDS life span of 275 years. Determine the basis of the property. For residential properties take your cost basis or adjusted cost basis if applicable and divide it by 275.

But according to the IRS measuring monthly accumulated depreciation for an asset depends on the profitable lifespan of the asset. Cost of property Land value Basis Basis 39 years Annual allowable depreciation expense 1250000 cost of property 250000 land value 1 million basis. You take the value of the item or the property itself as you will learn below and divide its value by the number of years in its reasonable.

Put another way for each full year you own a rental property you can depreciate 3636 of your cost basis each year. Method for calculating depreciation expense is as the following. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses.

To calculate your depreciation divide your property value by 275 and you get the. You cant deduct depreciation or insurance for the part of the year the property was held for personal use. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl.

Section 179 deduction dollar limits. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. The productive or profitable lifespan of the asset range from 3 to 20 years for private property.

The formula for depreciating commercial real estate looks like this. The formula for a 150 declining balance will be very similar to the 200 declining balance depreciation formula. Then you have the amount you can write off on your taxes as an expense each year.

Your adjusted cost basis in this property after the ten years is 95460 the original cost basis of 150000 minus 54540. Its a simple math problem to calculate depreciation. However you can include the home mortgage interest mortgage insurance premiums and real estate tax expenses for the part of the year the property was held for personal use when figuring the amount you can deduct on Schedule A.

To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life. We calculate the NOI of 11900 by subtracting all the expenses from the 18000 rental income. You take the value of the item or the property itself as you will learn below and divide its value by the number of years in its reasonable lifespan.

2 There is another way to do it and it could be very tax effective if you do it right. Its a simple math problem to calculate depreciation. To get the cap rate of Property Bs.

You should have written off about 54540 in depreciation deductions over those ten years. For real estate property there are basically two ways to calculate the depreciation expense. The most common method of calculated depreciation the General Depreciation System spreads depreciation equally over a term of 275 years for residential buildings.

The adjusted basis calculation I just showed above. If your cost basis in a rental property is 200000 your annual depreciation expense is 7273. All that one needs to do is to replace the 2 200 with 15 150.

Separate the cost of land and buildings. 15 to 20 years for land progress for real estate 275 years and for business real estate. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is 26200.

How To Calculate Depreciation On Rental Property

How To Deduct Rental Property Depreciation Wealthfit

How To Deduct Rental Property Depreciation Wealthfit

How To Calculate Improvement Ratio To Increase Depreciation Laptop Decal Search Engine Optimization Mirror Decal

Straight Line Depreciation Retipster

How To Use Rental Property Depreciation To Your Advantage

Free Arv Calculator Wholesale Real Estate Rental Property Investment Real Estate Houses

Understanding Tax Rules For Rental Property Aol Real Estate Rental Property Investment Real Estate Investing Rental Property Real Estate Investing

Depreciation Cost Residual Value Useful Life Depreciation Book Value X Depreciation Rate Book Valu Business Tax Deductions Business Tax Accounting

Straight Line Depreciation Formula Guide To Calculate Depreciation

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

How To Calculate Your Profit In 2021 When Selling Your Rental Property Mortgage Blog

Straight Line Depreciation Retipster

Never Pay Taxes Again Using Rental Properties Rental Property Investment Real Estate Investing Rental Property Rental Property